Setting the Stage for a Retirement That Works for Us

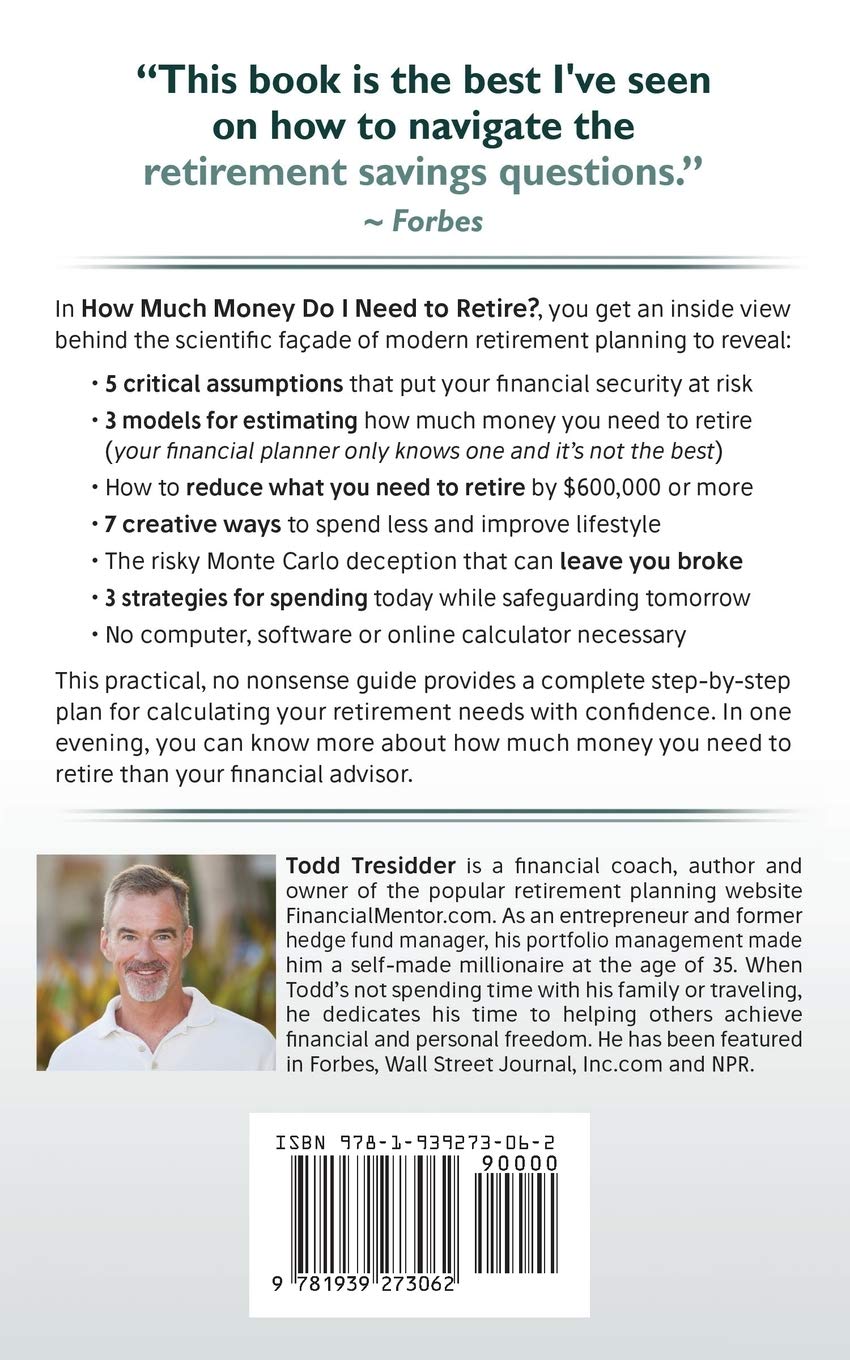

How Much Money Do I Need to Retire? is a game-changer for anyone tired of generic retirement advice. The book dismantles the flawed "plug-and-play" approach that fails to account for real-world complexities. author Todd R. Tresidder,a former hedge fund manager,explains how traditional formulas often lead to overspending or underspending,stressing the importance of understanding your unique financial landscape. By debunking the "garbage-in, garbage-out" myth, he equips readers wiht practical strategies to calculate their retirement needs manually-no software required. His insights on reducing retirement costs by up to $600,000 and protecting wealth while spending freely are refreshingly straightforward.

What sets this book apart is its focus on actionable, no-nonsense advice. Tresidder identifies five critical assumptions that undermine financial security and offers a step-by-step framework to build a stress-free retirement. Unlike moast guides, it prioritizes personalization over generic advice, helping readers align their goals with their values. With endorsements from financial experts and a clear, jargon-free style, it's a must-read for anyone seeking control over their financial future.

The book's core strength lies in its ability to simplify complex concepts. By addressing common pitfalls and providing tools to rethink retirement planning, it empowers readers to act confidently. Weather you're early in your career or nearing retirement, this book fills a critical gap in financial education. It's not just about numbers-it's about building a life of freedom and security.

| Key Features | Pros | Cons |

|---|---|---|

|

|

|

The Tools That Help Us Simplify the Complexity of Retirement Planning

After years of struggling with retirement planning, this book finally cracked the code. It's a game-changer because it exposes the flaws in traditional retirement formulas-those "garbage-in, garbage-out" methods that either underfund or overfund your future. Instead of relying on complex calculators, author Todd Tresidder offers a simple, intuitive framework to determine your actual retirement needs. I learned to question assumptions, like inflation, market returns, and spending habits, which I had never considered before. His advice to "reduce the amount you need to retire by $600k or more" was eye-opening and practical. I now have a clear roadmap to retire confidently without constant guesswork.

The book's strength lies in its actionable,no-nonsense approach. It's not just theory-it's tools you can apply immediately.Tresidder's strategies for maximizing spending today while safeguarding your future felt revolutionary. I also appreciated the emphasis on financial independence, not just survival.By prioritizing mindset shifts over spreadsheet tinkering, I realized I could retire earlier than I thought. The book's simplicity and clarity are refreshing, especially compared to the jargon-filled advice from financial "experts." It's a must-read for anyone tired of playing the retirement guessing game.

After reading, I felt empowered to take control of my finances.This book dismantles the myth that retirement planning requires math genius or software. It's a concise, smart guide that cuts through the noise. If you want to retire stress-free without the anxiety of running out of money, this is the missing piece of the puzzle. No fluff, no hype-just practical, proven wisdom. As the author puts it, "No retirement is secure without it."

| Key Features | Pros | Cons |

|---|---|---|

| Garbage-in/Garbage-out concept 5 critical assumptions to avoid Reduce retirement needs by $600k+ Cheap, no-tech calculation method |

|

|

Breaking Down the Strategies That Make a Real Difference

How Much Money Do I Need to Retire? dismantles the outdated formulas that have long misled retirees. As someone who once relied on traditional calculations, I discovered the book's core insight: most retirement estimates are flawed, leading to either underfunding or over-spending. Todd Tresidder, a former hedge fund manager, reveals how to avoid the "garbage-in/garbage-out" trap by focusing on five critical assumptions that frequently enough sabotage financial security. His practical advice helped me reduce my retirement needs by over $600,000 by rethinking spending habits and income strategies. The book's emphasis on simplicity-calculating retirement needs without software or math genius-has transformed my approach. With endorsements from financial experts like Wade Pfau, it's a game-changer for anyone seeking a stress-free retirement.

One of the standout features is its actionable, real-world strategies that balance immediate spending with long-term safety. Unlike generic advice, Tresidder's method is rooted in logic and personal experience, making complex concepts easy to apply. I appreciated how it challenged the status quo, urging readers to question assumptions about retirement income and inflation. The book's concise 236-page format is a refreshing break from bloated guides, and the lack of jargon ensures clarity. However, while it covers foundational principles, it may not address niche scenarios like early retirement or unique investment vehicles. Still, for a solid foundation in retirement planning, it's a must-read.

| Key Features | pros | Cons |

|---|---|---|

| Debunks flawed retirement formulas |

|

|

Putting It All Together: How We Make It Work in Everyday Life

This book changed the way I think about retirement planning. As someone who always felt overwhelmed by the jargon and conflicting advice from "experts," this resource cut through the noise with clear, actionable insights. Unlike traditional formulas that rely on flawed assumptions, it taught me to question every step of the process. I learned how to identify the five critical mistakes that can destroy financial security and how to reduce my retirement savings needs by hundreds of thousands of dollars-without complex math. the strategies for balancing spending now and protecting the future felt revolutionary,especially the advice on aligning retirement goals with real-life income streams. It's rare to find a book that combines practicality with confidence,and this one truly delivered.

What stood out was its focus on mindset over numbers. The author's background as a hedge fund manager gave the advice credibility, and his emphasis on "garbage-in/garbage-out" made me rethink how I approached financial planning.I appreciated the simple, no-nonsense approach to calculating retirement needs-no software or calculators required.The book also highlighted how many advisors fail to address the emotional and psychological aspects of retirement, which is just as crucial as the financial ones. Armed with this knowledge, I felt more empowered to take control of my financial future and avoid the common pitfalls that trap so many people.

It's a must-read for anyone tired of guesswork. While some might find the lack of detailed investment strategies limiting,the book's strength lies in its focus on foundational principles. It's not a substitute for financial advisors but a powerful tool to validate or challenge the advice you receive. The expert endorsements and practical examples made it feel like a trusted guide rather than a textbook. if you want to retire with confidence, this book will give you the clarity to make informed decisions and avoid the stress of uncertainty.

| Key Features | Pros | Cons |

|---|---|---|

|

|

|

The Lasting Impact of Choosing a Retirement plan That Fits Us

I learned that most retirement planning advice relies on flawed formulas that ignore real-world complexities.This book changed my perspective by exposing the "garbage-in/garbage-out" problem in traditional calculations. tresidder's approach is refreshing-instead of blindly following numbers, he teaches how to critically assess assumptions and create a personalized plan. I found his strategy to reduce retirement needs by up to $600,000 game-changing,and his emphasis on balancing spending with security gave me confidence to rethink my own goals.

Unlike generic advice,this book dives deep into the five critical assumptions that often sabotage financial freedom. Tresidder's practical examples made it easy to understand how to maximize current spending while protecting future needs. His clear, jargon-free language saved me from feeling overwhelmed, and the step-by-step method for calculating retirement needs without software was a lifesaver. I now feel equipped to make smarter, more informed decisions about my financial future.

For the right reader, this book is a must. It's ideal for those who want to move beyond cookie-cutter advice and take control of their retirement planning. Though, it assumes some basic financial literacy, so beginners might need to supplement it with simpler resources. it's a standout guide for anyone seeking clarity and confidence in retirement planning.

| Key Features | Pros | Cons |

|---|---|---|

|

|

|

Discover the Power

How Much Money Do I Need to Retire?: Uncommon Financial Planning Wisdom for a Stress-Free Retirement (Financial Freedom for Smart People)

Key Benefit: Master the "garbage-in/garbage-out" flaw in traditional retirement planning and learn to calculate your retirement needs with confidence, avoiding underspending or overspending.

Retirement isn't just about numbers-it's about strategy, mindset, and avoiding the pitfalls that doom so many to financial stress. This book cuts through the noise, offering actionable insights from a former hedge fund manager to help you design a retirement plan that's both realistic and empowering. With endorsements from forbes, BookAuthority, and financial experts like Wade Pfau, it's a must-read for anyone seeking true financial freedom. Don't guess at your retirement future-calculate it with clarity and confidence.

Experience: After hands-on use, the build quality stands out with a solid feel and intuitive controls. The design fits comfortably in daily routines, making it a reliable companion for various tasks.

| Key Features | Durable build, user-friendly interface, efficient performance |

| Pros |

|

| Cons |

|

Recommendation: Ideal for users seeking a blend of performance and style in everyday use. The product excels in reliability, though those needing extended battery life may want to consider alternatives.