Price: $12.99 - $144.86

(as of Apr 07, 2025 03:34:52 UTC - Details)

The Best Online Banking: A Comprehensive Review

Introduction

In today’s fast-paced world, finding the best online banking options can make a significant difference in how you manage your finances. With the rise of digital banking, consumers are looking for convenience, security, and a user-friendly experience. In this article, we’ll dive deep into the best online banking services available, exploring their features, benefits, and what makes them stand out. Whether you’re seeking high interest rates, low fees, or robust customer support, you’ll find valuable insights to help you choose the right online bank for your needs.

Understanding Online Banking

What is Online Banking?

Online banking refers to the process of managing your finances through the internet. This service allows you to perform a variety of banking activities, such as checking your balance, transferring funds, and paying bills without visiting a physical bank. The convenience of online banking has made it increasingly popular among consumers who want to streamline their financial management.

Why Choose Online Banking?

One of the primary reasons people opt for online banking is convenience. With 24/7 access to your accounts, you can perform transactions anytime, anywhere. Additionally, many online banks offer competitive interest rates, low fees, and a seamless user experience. This section will explore some of the benefits of online banking in detail.

Key Features of the Best Online Banking Services

High-Interest Rates

When searching for the best online banking options, high-interest rates are often at the top of the list for consumers. Many online banks offer savings accounts with interest rates that exceed those of traditional banks. This means your money can grow faster, helping you achieve your financial goals more effectively. Look for banks that provide competitive rates and consider how they compare to the national averages.

Low Fees

Another critical factor to consider is the fee structure of online banks. Many of the best online banking options come with minimal to no monthly maintenance fees, which can save you a significant amount over time. Make sure to review the fee schedules of various banks, including ATM fees, overdraft fees, and transaction fees, to choose one that aligns with your financial habits.

User-Friendly Mobile Apps

In a world where everything is at our fingertips, a user-friendly mobile app is essential for any online banking service. The best online banks prioritize creating intuitive mobile experiences that allow you to manage your finances easily. Features to look for include easy navigation, bill payment options, and budgeting tools. A good app can make a significant difference in your overall banking experience.

Robust Security Measures

With the rise of online banking comes the need for robust security measures. The best online banking services utilize advanced technology to protect your personal information and account details. Look for banks that offer two-factor authentication, encryption, and fraud detection services. Knowing your money is secure can provide peace of mind as you manage your finances online.

Excellent Customer Support

Even in the digital realm, having access to reliable customer support is crucial. The best online banking services offer multiple ways to reach customer service representatives, including chat, email, and phone support. Look for banks that provide comprehensive FAQs and support resources, so you can find answers quickly when you need them.

Innovative Financial Tools

Many online banks offer innovative financial tools that can help you manage your finances more effectively. From budgeting apps to savings calculators, these tools can provide insights into your spending habits and help you set and achieve financial goals. Explore the features provided by different banks to find one that offers the tools that best suit your needs.

Comparing the Best Online Banks

Top Picks for Online Banking

Bank A: The High-Interest Champion

Bank A is known for its exceptional interest rates on savings accounts. With rates significantly higher than the national average, it’s an excellent choice for anyone looking to grow their savings. Additionally, Bank A has a user-friendly mobile app and offers minimal fees, making it a top contender in the online banking landscape.

Bank B: The Fee-Free Option

If you’re tired of paying monthly maintenance fees, Bank B might be the solution for you. This online bank prides itself on offering a completely fee-free experience, making it an attractive option for consumers. With a solid mobile platform and robust security measures, Bank B is a reliable choice for those looking to save money on banking fees.

Bank C: The Customer Support Leader

For those who prioritize customer service, Bank C stands out with its exceptional support. With multiple channels for reaching customer service representatives and a wealth of online resources, Bank C ensures that help is always available. Coupled with competitive interest rates and a user-friendly app, it’s a great choice for anyone who values support.

Final Thoughts on Choosing the Right Online Bank

When it comes to selecting the best online banking service, it’s essential to consider your individual needs and preferences. Whether you prioritize high-interest rates, low fees, user-friendly apps, or excellent customer support, there’s an online bank that can meet your banking requirements.

Conclusion

In conclusion, finding the best online banking service can significantly enhance your financial management experience. By focusing on key features such as high interest rates, low fees, and robust customer support, you can make an informed decision that aligns with your needs. As online banking continues to evolve, staying informed about the best options available will help you make the most of your financial journey. Whether you’re a seasoned online banking user or new to the digital world, there’s a perfect online bank waiting for you.

By prioritizing your financial goals and understanding the available options, you can enjoy the benefits of online banking and take control of your finances like never before.

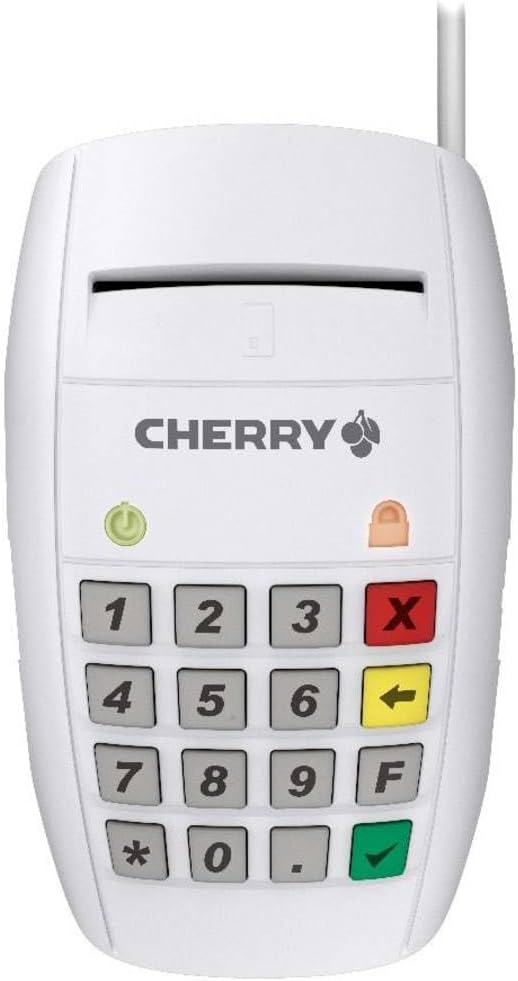

High-quality USB smart card reader: Reads electronic health cards and health insurance cards for applications outside of telematics infrastructure

Secure PIN entry (Class 2 reader): Can be conveniently used for electronic signatures or online banking. 16-key PIN keypad allows direct PIN input

Solid and high-quality construction: one-handed operation thanks to its high weight and stable support. It also impresses with its pleasant pressure point and feel. Compatible with CT-Api and EMV

Support 4.2: CT-Api for direct capture of health cards

CCID (Chip Card Interface Device) compatible smart card terminal: Communication protocol for connecting smart card readers to a computer system via USB (Universal Serial Bus)